Introduction

On January 28, 2026, Meta Platforms shattered expectations with a transformative financial forecast that signals a seismic shift in corporate strategy. The company's decision to commit between $115–$135 billion to capital expenditures in 2026 alone—nearly doubling its 2025 spending—represents one of the most aggressive infrastructure bets in tech history. But beneath these eye-watering numbers lies a carefully engineered financial narrative: Meta is attempting to convince investors that it can simultaneously fund the race toward artificial superintelligence while maintaining its core advertising profitability. Let's break down what the numbers actually tell us.

The $125 Billion Question: A New Capex Regime

Meta's 2026 capital expenditure guidance of $115–$135 billion dwarfs the company's historical spending patterns. For context, Meta spent $72.22 billion on capex in 2025. The midpoint of the 2026 guidance ($125 billion) represents a 73% year-over-year increase—a spending trajectory that few companies would dare announce without ironclad conviction.

What drives this astronomical figure?

According to Meta's official guidance and recent earnings calls, the primary drivers are:

- Data Center Infrastructure: Massive buildouts of GPU clusters (H100/H200s) and proprietary "MTIA" silicon manufacturing

- Third-party Cloud Spend: Payments to cloud providers including Google Cloud and Amazon Web Services

- Depreciation & Operating Expenses: The operational costs associated with managing a global fleet of AI data centers

- Meta Compute Initiative: A newly announced infrastructure division focused on securing compute capacity and global partnerships

Meta's official statement emphasizes that "year-over-year growth [is] driven by increased investment to support our Meta Superintelligence Labs efforts and core business." This is not hyperbole—it's structural.

The Revenue Engine: Why Wall Street Isn't Panicking

What separates Meta's AI bet from other speculative tech plays is a brutally simple fact: Meta's core advertising business is humming at historic efficiency levels. In Q4 2025, the company delivered:

- $59.89 billion in quarterly revenue (beat: +2.5% vs. consensus)

- $8.88 in diluted EPS (beat: +8.4% vs. consensus)

- 24% year-over-year revenue growth, driven entirely by AI-powered ad conversion improvements

The financial model projects revenue growing at 24% annually through 2029, reaching $475 billion by year-end 2029 (from a 2025 base of $201 billion). This is not gradual—it is exponential.

More critically, Meta "paired [the spending plan] with a Q1 revenue outlook of $53.5 billion to $56.5 billion that topped many expectations," signaling that the company believes its AI investments are already translating into immediate top-line acceleration. Wall Street rewarded this conviction with an initial 10%+ stock jump, suggesting investors believe Meta has de-risked the superintelligence bet through current-quarter performance.

The Dual-Engine Strategy: Advertising Today, Superintelligence Tomorrow

Meta's financial forecast rests on a sophisticated dual-engine architecture:

Engine 1: Family of Apps (The Cash Cow)

The company's traditional business—Facebook, Instagram, Messenger, and WhatsApp—generates nearly

100% of current revenue through performance-based advertising. The 2025 breakthrough was AI-powered

ad generation tools that allow advertisers to create entire campaigns from text prompts. This

innovation has systematically improved the "average price per ad," a critical metric that exceeded

guidance by 6–9% in Q4 2025.

Engine 2: Superintelligence Labs (The Moonshot)

Led by newly hired Chief AI Officer Alexandr Wang (formerly of Scale AI), this unit is building

frontier large language models (LLMs) intended to advance toward artificial general intelligence

(AGI). The financial model assumes that by 2028–2029, these models will power a new generation of

"personal superintelligence" products—though the monetization pathway remains strategically vague.

The tension here is real. Observers note that "whether Meta will have much by way of new AI products that can generate revenue remains a major question, and one Zuckerberg hasn't clearly answered." Nevertheless, the market has chosen to extend Meta the benefit of the doubt, at least for now.

The Financial Model Tells a Nuanced Story

Our integrated 3-statement financial forecast (2026–2029) reveals several critical dynamics:

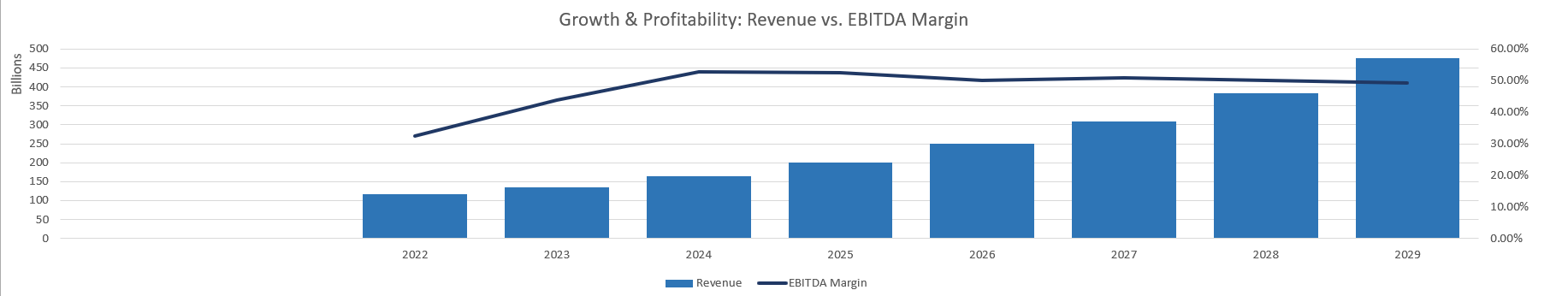

Revenue & Profitability Trajectory

| Metric | 2025 | 2026E | 2027E | 2028E | 2029E |

|---|---|---|---|---|---|

| Revenue (B) | $201.0 | $249.2 | $309.0 | $383.2 | $475.1 |

| Growth Rate | 22.2% | 24.0% | 24.0% | 24.0% | 24.0% |

| EBITDA Margin | 52.6% | 50.1% | 50.7% | 50.1% | 49.3% |

| Net Margin | 30.1% | 29.7% | 30.0% | 30.4% | 30.7% |

The forecast assumes stable operating leverage despite massive capex increases. EBITDA margins compress from 52.6% (2025) to 50.1% (2026) due to higher infrastructure depreciation, but remain elevated by historical tech standards.

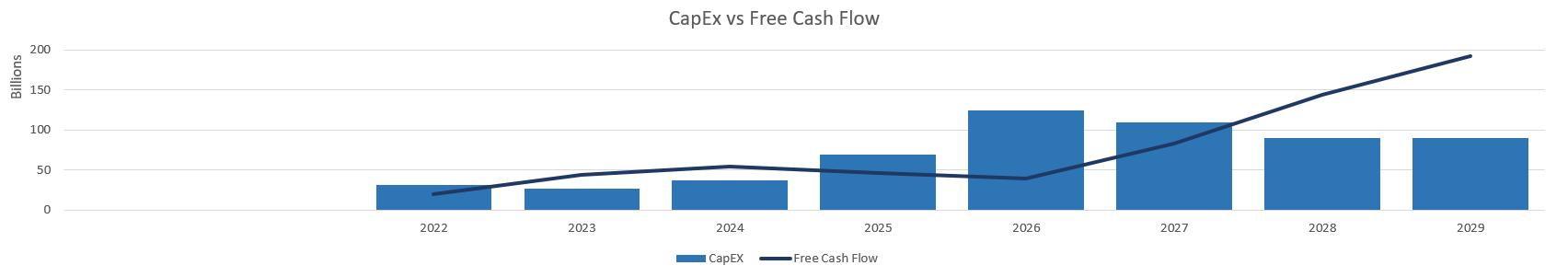

The Free Cash Flow Puzzle

Here's where the model becomes philosophically interesting. Free cash flow (FCF) actually declines from $46.1 billion (2025) to $38.9 billion (2026)—a 16% contraction—despite revenue growing 24%. Why? Because capex jumps from $69.7 billion to $125 billion. However, the model projects FCF recovery to $80–$191 billion by 2029, assuming capex moderates to $90 billion annually after the 2026 build-out.

This narrative relies on a critical assumption: Capex intensity normalizes after 2026. If the AI arms race intensifies and Meta must maintain $110B+ annual capex through 2029, FCF could remain permanently suppressed, fundamentally altering the investment thesis.

Analyst & Market Sentiment: The Debate

The market reaction to Meta's guidance has been decidedly bullish, but beneath the surface, investors are grappling with genuine concerns.

The Bull Case

Wall Street analysts have expressed optimism, noting that "investors took comfort in the company's latest results, which showed 24% year-over-year revenue growth, driven by online ads." The core argument is straightforward: Meta's proven ability to monetize its 3.58 billion daily active users through AI-enhanced advertising provides a war chest to fund experimental infrastructure spending without near-term financial distress.

Additionally, commentators note that Meta's guidance "promises that operating income in 2026 will land above 2025 even after the spending step-up," demonstrating management confidence in offsetting capex increases through operational efficiency.

The Bear Case

However, intelligent skeptics raise legitimate concerns:

- Infrastructure Overhang: There is a growing concern among institutional investors that Meta's $100B+ annual spend on AI infrastructure might not yield proportional returns if AI-driven ad efficiency hits a ceiling. As one analysis notes, "There is a growing concern among investors that the $100B+ annual spend on AI might not yield a proportional return on investment (ROI) if AI-driven ad efficiency hits a ceiling."

- Regulatory Risk: "In January 2026, landmark youth safety trials began in Los Angeles. If found liable for 'social media addiction,' Meta could face settlements in the billions." These lawsuits, combined with ongoing EU regulatory pressure, create tail-risk scenarios not fully captured in the base-case forecast.

- Monetization Uncertainty: While Llama 4 ("Behemoth") is expected in early 2026 and Ray-Ban Meta smart glasses are generating buzz, the pathway to revenue remains opaque. How do you price superintelligence? Is it a software license, a SaaS subscription, or an embedded service? The market hasn't yet answered this question.

The Superintelligence Bet: Strategic Context

To understand Meta's 2026 forecast, one must grasp the competitive context. "The tech sector in 2026 is defined by the 'Capex Arms Race.' Meta is expected to spend between $115 billion and $135 billion on capital expenditures in 2026 alone, primarily on custom 'MTIA' chips and massive server farms."

Zuckerberg's recent leadership hires signal serious intent. "Alexandr Wang: Hired as Chief AI Officer (formerly of Scale AI), Wang leads the 'Superintelligence Labs' unit, signaling Meta's intention to lead in the race toward AGI (Artificial General Intelligence)." This $14.3 billion investment (49% stake in Scale AI plus executive acquisition) represents the single largest strategic hire in Meta's history and underscores that the company views the AI race as existential.

Key Financial Metrics & Assumptions

Our forecast is anchored in several critical assumptions that investors should monitor:

| Assumption | 2026 Value | Rationale |

|---|---|---|

| Revenue Growth | 24.0% | Driven by AI-powered ad-conversion lift and Q1 2026 guidance ($53.5–$56.5B) |

| CapEx (PPE) | $125.0B | Midpoint of official guidance ($115–$135B) for "Meta Compute" infrastructure |

| Tax Rate | 20.0% | Effective blended rate (federal, state, international); guidance suggests 13–16% possible |

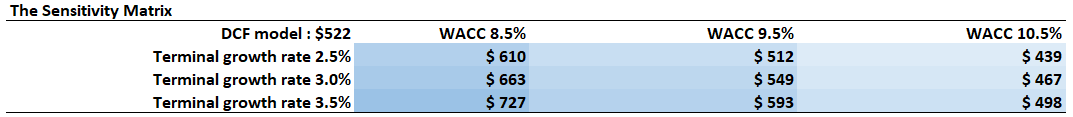

| WACC | 9.5% | Market-standard for high-cash-flow mega-cap technology; beta of 1.2 |

| Terminal Growth | 3.0% | Conservative perpetual growth assumption for DCF terminal value |

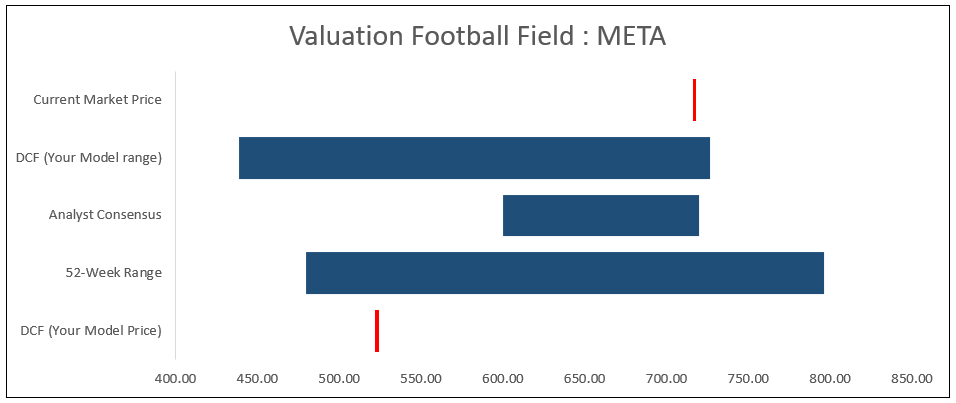

Valuation Implications: The "Optimism Premium"

Our discounted cash flow (DCF) valuation yields an implied share price of $522, somewhat below Meta's current trading price of $716 (~$716 as of late January 2026). This 37% gap reflects meaningful but not dramatic valuation disagreement, and the difference hinges on critical assumptions about capex trajectory and superintelligence monetization.

The gap reflects two distinct but reasonable views:

- Conservative Base Case Valuation ($522): This valuation assumes:

- Capex moderates to $90 billion annually starting in 2027 (after the 2026 peak)

- Operating margins remain stable at 50%+ through 2029

- FCF grows from $38.9B (2026) to $191.5B (2029) as capex intensity normalizes

- Superintelligence contributes to AI-driven advertising improvements but doesn't generate incremental major revenue lines until 2030+

- The model uses a 9.5% WACC and 3% terminal growth rate

- Optimistic Market Case Valuation ($716+): Assumes that:

- Superintelligence breakthroughs accelerate revenue growth beyond 24% in 2028–2029

- New product lines (AI agents, Llama licensing, advanced wearables) generate material revenue/margin uplift not yet in guidance

- Capex intensity declines faster than modeled, improving FCF conversion

- Market applies a valuation multiple premium (1.3x–1.4x) for optionality on AGI/superintelligence outcomes

This reflects the market's willingness to pay for transformational upside optionality, not a belief that the base case is wrong.

The $194 gap between these cases is not a debate about Meta's financial health—it's a debate about whether superintelligence will unlock new revenue categories. Both valuations assume strong profitability and growing FCF through 2029.

The Path Forward: What to Watch in 2026

As Meta executes on its $125 billion capex plan, several milestones will determine whether this bet pays off:

- Q1–Q2 2026 Revenue Guidance: Does Meta continue to beat revenue expectations, or does growth decelerate as the market saturates?

- Llama 4 Behemoth Launch: Will the new flagship model deliver the promised human-level reasoning capabilities, and will it outpace OpenAI's GPT-5?

- Ray-Ban Meta Glasses Adoption: Can wearable AI become a meaningful revenue driver, or will it remain a curiosity?

- Regulatory Outcomes: What is the final settlement in the youth safety trials, and how material are the damages?

- Capex Execution: Can Meta deliver on its infrastructure roadmap without cost overruns, supply chain disruptions, or project delays?

- FCF Recovery: By 2027–2028, does free cash flow begin recovering toward the $80–$100B range as capex moderates?

Conclusion

Meta's 2026 financial forecast is not conservative. It is a $125 billion bet that superintelligence will become the next major computing platform, that Meta's 3.58 billion-person social graph will be the distribution channel, and that the company's proven advertising prowess will continue to fund the research.

The numbers support a company in confident growth mode. Revenue is accelerating at 24%, margins remain robust at 50%+, and the balance sheet has the capacity to absorb capex spikes without financial distress. As one market analyst noted, "Meta handed [investors] a story — and Meta handed it one: strong advertising now, enormous AI buildout next, and enough confidence to promise that operating income in 2026 will land above 2025 even after the spending step-up."

Yet the forecast also reveals the inherent tension in Meta's dual-engine strategy. For the bull thesis to materialize, the company must execute flawlessly on both fronts: monetizing superintelligence while defending its advertising moat against regulators, competitors, and market saturation. Miss on either, and the 37% valuation gap could collapse.

Investors should approach Meta in 2026 with nuanced skepticism—not dismissing the superintelligence opportunity, but demanding proof that the infrastructure spending will ultimately translate into shareholder value. The next 12 months will tell us whether Zuckerberg's vision is prescient or costly.

Related Project: For a deeper dive into the numbers, including a full breakdown of the 3-statement model and sensitivity analysis, check out my detailed Meta Financial Report (FY 2026) project.